Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Unfortunately Plan Administrators are rarely experts in group insurance and are likely responsible for more than just their PA duties. Plan Administrators have access to large amounts of sensitive employee data, such as dates of birth, dependant details and salaries. It is therefore important to choose the correct person for this role.

Here are a few of the items that a Plan Administrator is responsible for on a regular basis:

- Updating salary information: Salaries often change annually, but can also change at any point in the year due to promotions or pay raises. Several group benefits such as Life, Short Term Disability and Long Term Disability have premiums based on an employee’s salary. Any claims for these benefits will use the salary information currently on record for that employee (as that is what their premiums have been based on). Not keeping salaries up to date can have serious consequences, for example an employee’s disability benefit could be lower than anticipated because it is based on their salary from several years ago. Because the premiums for these benefits are often salary based, updating a certificates salary details in the admin system will likely increase the premiums they are paying.

. - Updating employee’s key information: Employee details change over time and can have a material impact on their employee benefits. Perhaps they recently got married or had a child, which means new dependant information to capture and potentially a change in their family status. Job changes can impact an employee’s salary, but it can also impact which benefits class they are in (for example moving from the regular employees class into the management class). Switching from part time to full time, or vice versa, could impact their eligibility for group benefits. All of these things need to be tracked in the admin system by the PA.

. - Adding new employees: Timely enrolment of new employees is important to ensure they receive their appropriate coverage without penalty. Insurers can impose restrictions on coverage or require additional medical evidence for employees that are considered late enrolee’s in the plan.

. - Cancelling employees: Just as important as adding new customers is ensuring that employees are cancelled as soon as they are no longer eligible. This will help to control the group’s overall claims experience. Note that there are several cancellation circumstances that will automatically be handled by the insurance company, for example when employees reach the termination age they will automatically be cancelled.

. - Billing: Plan Administrators are often the ones tasked with handling the monthly invoices for group insurance, ensuring that payments are kept up to date. This is important to ensure that claims are paid promptly.

. - Record keeper: Once a group plan is initially setup it is common for the Plan Administrator to become the key record keeper. This means it will be their responsibility to keep paperwork such as enrolment forms for new employees, rather than sending these in to the insurance company.

. - Supporting Employees: Plan Administrators act as a key resource for employees when dealing with group insurance enquiries. They are often the first port of call for employees questions regarding plan coverage. The expectation is not that PA’s are intimately familiar with the ins and outs of the groups benefit plan (although it certainly helps) but they often provide resources such as replacement benefit booklets, claim forms and important announcements.

. - Pulling together documents: This can start in the marketing phase when the PA will need to provide up to date employee data to the Insurance Advisor to accurately market the group. If the group chooses to switch insurance carriers it often falls to the PA to help gather all the required documentation, such as updated enrolment forms for all employees. The PA may also be involved in distributing the new documents such as new enrolment cards, benefit booklets and marketing materials.

These are just some of the important tasks that PA’s are involved in. Most insurers will provide a handbook or guidance to help PA’s understand their duties and teach them how to use the administration system.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

To counteract this, insurance carriers create a buffer of premiums which are to be used to cover claims in the event a group cancels coverage. This buffer is referred to as the IBNR charge and is usually expressed as a % of premiums or as a % of paid claims. This premium is reserved at the end of the first renewal and is held to cover IBNR claims. Therefore this amount is not included in the experience rating renewal calculations. In subsequent renewals the IBNR is recalculated and the previous IBNR is released, which in effect means the customer is only paying for the difference. In this way the IBNR premium being held is always reflecting the most recent experience.

IBNR charges differ between insurance carriers and products and should be reviewed as part of an overall marketing check. Higher IBNR %’s tie up more premiums, which will increase renewal rates. With the advent of more efficient methods for submitting a claim, such as online claims portals, drug cards and smart phone apps, IBNR charges have slowly been reducing as the delay between incurring a claim and reporting it is reducing.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

.

Why am I being medically underwritten?

A common question from employees is why am I being medically underwritten? This can be particularly concerning for employees if some members of the group are being medically underwritten and others aren’t.

There are two main scenarios that would lead to medical underwriting on a Group policy:

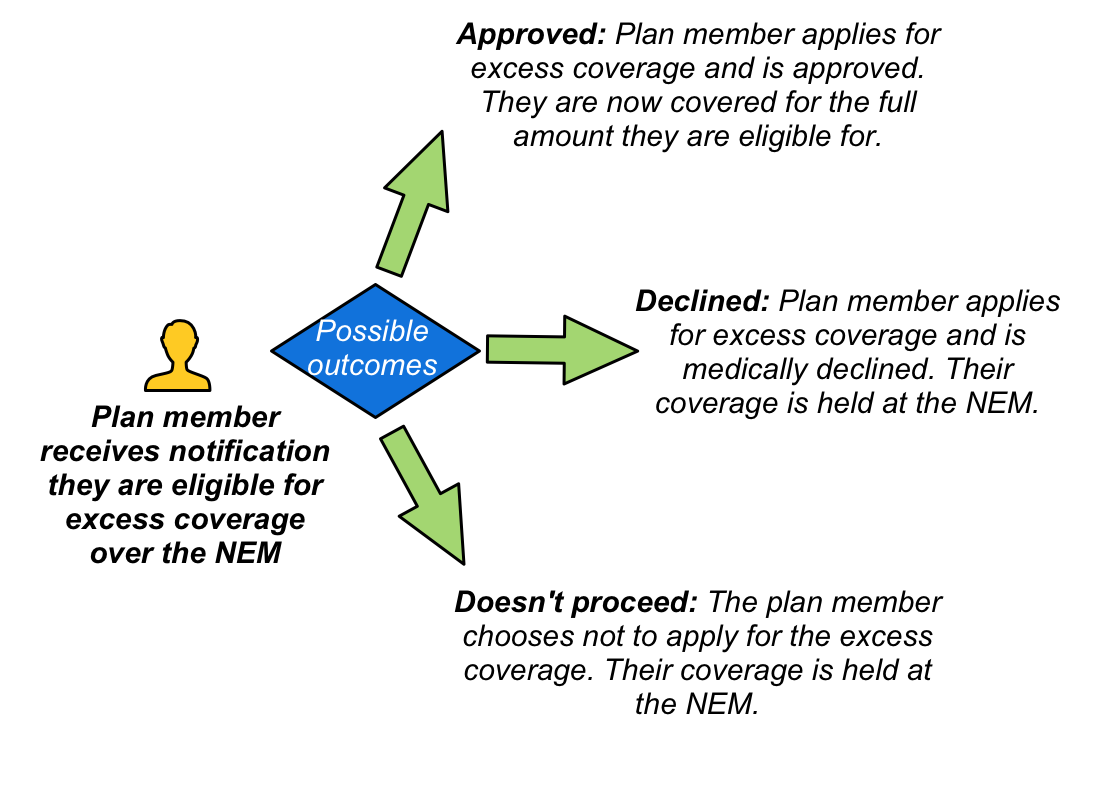

- Coverage above the Non-Evidence Maximum: When employees are eligible for coverage above the NEM then medical underwriting is required to approve this addition coverage. Note that even if the employee is declined excess coverage for medical reasons they will still have the coverage up to the NEM. Also note that one benefit may be approved while others are declined. For example, a medical condition may pose an unacceptable disability risk, but not increase the risk of death.

- Late enrolee: If an employee chooses to waive all coverage of the benefits plan but later decides to join the plan then medical underwriting from first dollar may be required. This means if the employee fails the medical underwriting they will not have any coverage, even up to the NEM amount. Note that medical underwriting is typically not required if EHB and Dental were waived due to the employee having coverage through their spouse.

Types of medical underwriting

There are different levels of medical underwriting, depending on insurance carrier guidelines and the amount of coverage being requested:

.

Medical Questionnaire

The simplest form of medical underwriting is the completion of a medical questionnaire. Depending on the answers provided in this form, a medical underwriting decision may be able to be made without any further tests.

Sometimes the answers on this initial form will trigger a more detailed questionnaire. For example, if an employee mentions on their medical questionnaire that they recently had knee surgery, then they may be asked to fill in a more detailed questionnaire specific to knee injuries.

It is important to be truthful on the medical questionnaire. The information provided is often validated with the employees doctor to ensure accuracy. In addition, any future claims may be deemed void if it becomes apparent that the medical questionnaire was not completed accurately.

.

Medical exam

A medical exam may be required to complete the medical underwriting process. The usual process is that a registered examiner will contact the employee to arrange a time and place to meet and perform the assessment. This can be at the employees home or at work, or another convenient location that affords suitable privacy.

As part of the examination, the employee will answer a series of questions and their height and weight will be measured. Fluids may also be required as part of this assessment, including urine and blood. More comprehensive tests such as echocardiograms may be required, depending on the coverage being requested.

A final decision can take several days once all the required information has been received.

.

Frequently Asked Questions

Here are some questions that employees may ask, and how to answer them:

- I was recently approved for individual coverage, why was I declined for my group coverage?

For individual coverage, there is an option to ‘rate’ a person depending on the risk they represent. This means older individuals, or those with health conditions, may still be able to get individual coverage, but the rate they pay will be considerably more. For group insurance, rating is not an option. All employees in the same class pay the same rate. The intention of Group medical underwriting is therefore solely to determine if an employee presents a ‘standard risk’. - I was recently medically underwritten somewhere else for group or individual coverage, can they reuse the tests?

This may be an option, depending on which tests were performed and when. Check with your insurance carrier. - My doctor says I am healthy, why am I being declined?

A doctor typically assesses your health at a point in time. The intention of group medical underwriting is to also consider your future risk. Being medically declined for group insurance in no way implies you are not currently healthy. - What if I don’t want the excess coverage over the NEM?

You can choose not to proceed with medical underwriting, but note that you may not have the option to add this additional coverage down the road. You should also ensure that the coverage you have will meet your needs. For example, could you survive for a year if you were unable to work and only receiving 40% of your currently salary? - I’ve been declined. When can I reapply?

This is usually communicated as part of the decline letter. It could be an amount of time, or conditional. For example, you may be eligible to reapply in 12 months, or when you have been symptom free for six months. Some conditions may not allow for reconsideration.

Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Waived – the employee opts not to participate in this particular benefit. This is typically due to coverage being available through an alternate plan, most commonly their partner’s plan. Note that if this is the case, the employee should only waive coverages that they have elsewhere, such as EHB and Dental. They should not waive all coverages (in effect opting not to join the plan) as this will leave them without key benefits such as Life, AD&D, LTD and critical illness. Waiving all coverage may cause issues if the employee later opts to join the plan. Full medical underwriting will likely be required.

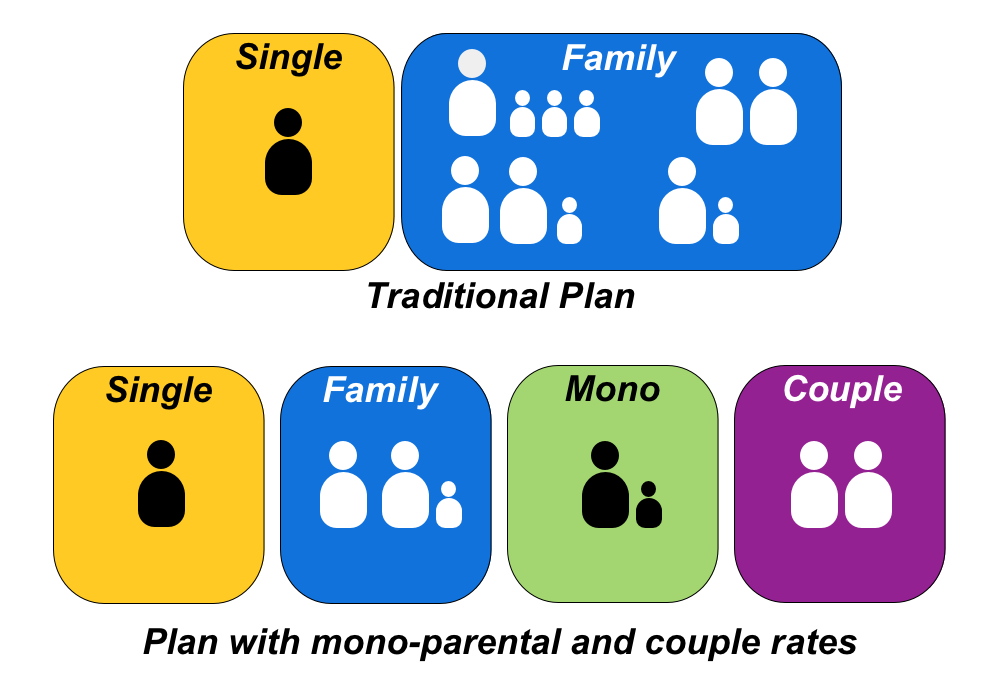

Single coverage – coverage only applies to the employee. No claims can be made by any other dependant. Single coverage has a lower rate, as the risk exposure is significantly less and it is clear exactly how many people are being covered (one).

Family coverage – coverage applies to the employee and all eligible dependants. The definition of eligible dependants differs from carrier to carrier, but in general it covers one spouse and an unlimited number of children, provided they are under a pre-determined age (most commonly 22) and remain dependant on their parents. Children that study full time may be covered past the age limit. The number of dependants covered via each employee will change over time, as young families have children or the children of older couples become ineligible. The number of dependants doesn’t effect the rate that each employee pays, all employees with family coverage in the same class will pay the same family rate.

It is the catch all nature of the family status that led to the creation of mono-parental and couple rates. These options are typically not included unless requested. Note that one or both of these can be added, meaning you could opt to add couple rates but leave single parents in the family class. Because family rates can cover any number of dependants they are typically more than twice the single rates. Couple and mono-parental rates sit somewhere between the single rates and family rates.

These statuses are somewhat self explanatory but here’s a quick overview of what they cover:

Couple coverage – this coverage is for two adults without children.

Mono-parental coverage – this coverage is for a single parent with any number of dependant children.

Risks & other considerations

Having additional family statuses does create more administration as employees have more statuses to move between. For small groups it can also make the plan more complicated and spread the experience out amongst more groupings. For this reason these additional statuses may not be available, depending on the size of the group and the carriers quoting.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

ASO is typically only available for a subset of benefits and may have additional restrictions, such as requiring a particular number of members in the benefits plan. This is because on ASO the risk lies with the policyholder and so it is in the insurance companies interest to ensure the client is of sufficient size to absorb the potential swings in cost that an ASO benefit may see.

Not all benefits are well suited to ASO. It is typically the experience rated benefits such as EHB and Dental that are sold on an ASO basis. Benefits such as Life, Out of Country coverage and LTD have low claims incidence but very high cost claims, making them ill suited to the ASO model. For these benefits the risk remains with the insurance company, which is referred to as Fully Insured.

There is nothing stopping a policyholder from mixing and matching, having ASO dental and fully insured EHB, or vice versa. It is also possible to switch from an existing fully insured EHB or dental plan to an ASO model, or vice versa.

Where should I start?

Dental is the typical starting point for groups to try ASO, as dental has clearly defined limits and even the most expensive dental treatment is usually within the thousands of dollars range. Most dental work is routine, making the experience more predictable. ASO dental is typically available at a lower number of lives, making it an option for smaller companies.

ASO EHB on the other hand can expose a group to very high risk, with a single employee or dependant on a recurring drug having the potential to cost the policyholder tens of thousands of dollars every year. Stop loss still exists on ASO policies and claims above the stop loss remain fully insured, so the exposure is not unlimited, but it is potentially far more volatile than dental. Plan design, co-insurance and maximums can be used to control risk exposure, but as always they leave the possibility of employees with large claims being out of pocket.

ASO billing options

There are a few different ways that ASO benefits can be billed. One is a traditional pay as you go model, where the experience at the end of the month is billed directly to the customer, plus the administration fees. This leaves the potential for volatility in the month to month cost but means there is nothing to settle at the end of the year.

An alternative is budgeted ASO, where the customer pays the same amount each month and at the end of the year any difference is settled. If the client paid too much they can ask for a refund, or use the surplus to offset next years rates. If claims exceeded what was paid then the client must pay the difference. At the end of each year the budgeted ASO rates are negotiated, but this is purely to try to avoid a large surplus or deficit at the end of next year, no matter what rates are negotiated the cost of the claims must still be covered.

Health Care Spending Accounts

An increasingly popular ASO benefit is a Health Care Spending Account (HCSA) which is essentially a bucket of money that employees can chose to spend on anything covered by the Canada Revenue Agency guidelines. This can be used to top up existing coverage or in place of a more traditional benefits plan. The advantages of a HCSA is that it provides flexibility to employees, allowing them to chose where to spend their benefit dollars, while still controlling the risk exposure for the policyholder. Allowances can be allocated annually, bi-annually or quarterly to further control the exposure, useful for companies with high turnover. Leftover balances can often be transferred to the next period, although limitations apply. You can read more about HCSA’s here.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

When a benefit is experience rated it means that some portion of previous claims are taken into consideration when setting future rates. This is far from an exact science, you are in effect using the past to try to predict the future. Every group has it’s own unique set of circumstances, employees get sick and recover, employees leave and are replaced, generic drugs become available and new drugs are developed. The benefit plans themselves are not static either, with changing maximums, waiting periods and co-insurances all having an effect on the groups overall experience.

How experience is calculated, and the portion of previous claims that are taken into account, depend on a number of different factors:

.

Credibility

Credibility, simply stated, is how likely a groups claims experience is to be similar next year. It is stated as a % from 0 to 100% credible. Larger groups enjoy greater credibility as a single employees claims have less influence over the overall experience, which makes the groups experience more stable and easier to predict. Put a different way, one employee suddenly experiencing higher claims will have less of a dramatic impact on the experience of a large group. There is also a greater spread of risk on large groups, meaning that for every certificate with high claims there will be several with lower claims, creating an offset that helps to balance the overall experience.

Having a higher credibility may not necessarily be an advantage if the groups claims experience is high. For groups with credibility below 100%, the difference is made up using the insurance carriers manual rates for that benefit. These are calculated using a number of factors such as demographics and province of residence. The groups experience and manual rates are blended together to calculate the overall experience rate.

.

Multi-year experience

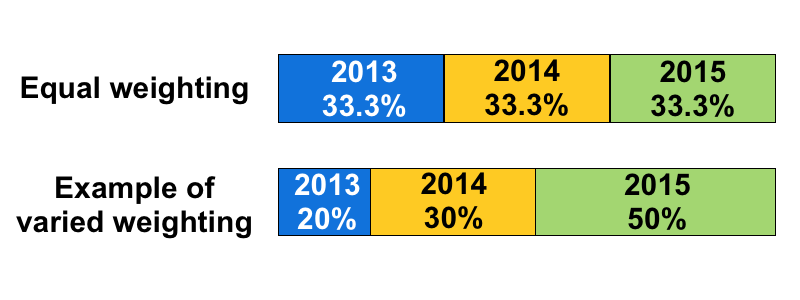

Particularly at quote time, several years experience may be taken into consideration when determining the correct rates for an experience rated benefit. When multiple years are used they may be weighted equally or more weight may be given to more recent years experience. Every carrier has their own methodology for how many years experience to use and how to weight each year.

Trend and Inflation

Items such as drugs and dental work typically get more expensive over time, which is commonly referred to as inflation. However other factors are also taken into account for this calculation. Are dispensing fees increasing? Is utilization increasing due to the aging workforce? What cost shifting is occurring from provincial plans? Are alternative treatments to existing conditions becoming available, for example the recent advancements in treating Hepatitis C. All of these things are taken into consideration to calculate an overall trend.

.

Target Loss Ratio

We’ve already covered TLR’s in depth in a separate post, but to recap they play a major part in an experience rating calculation. Even a group that looks like the claims are below premiums may still require a rate increase to align with the overall target loss ratio. Higher TLR’s are considered better as more premium dollars are available to cover claims.

.

Stop Loss/EP3

We’ve covered Stop Loss before too, but as a reminder the stop loss is an upper threshold that removes all claims from a groups experience that exceed the stop loss. For example if a group has a $10k Stop loss and an employee has $20k of drug claims, only the first $10k of those claims will be included in the groups experience rating calculation.

.

Incurred But Not Reported (IBNR)

We’ve covered IBNR in detail, but as a summary it refers to a reserve held by the insurance company to cover claims that have already been incurred but have not yet been reported (and therefore are not currently reflected in the experience). IBNR charges are removed from experience rated calculations, increasing the loss ratio.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Benefits such as Life, AD&D, Dependant life, LTD and Critical Illness are all typically rated using a pooled approach. This is due to the low claim incidence but high cost claims. For example, a group could go for several years without ever having a life claim, but than suddenly make a life claim for $500k. No group, particularly a small group, is ever going to generate $500k worth of Life premiums, so there is no chance of this one group ever covering the cost of that single claim. To counteract this, the Life premium from several thousand other groups are all ‘pooled’ together and used to cover the cost of all of the pools Life claims. This is a very similar model to other types of insurance, such as property insurance, where the % of customers that make a claim are very small, but the claims themselves are very large.

Rates for pooled benefits are influenced by the overall experience of the pool. This means if the claims experience of the pool was higher than expected, all groups within that pool may see an increase, regardless of their own claims experience or manual rate adjustments.

Manual Rates

To calculate rates for pooled benefits, manual rates are used. These are exactly what they sound like, rates from an underwriting manual. These manual rates are determined by actuaries and are regularly reviewed and updated.

Each employee’s manual rate is calculated and then these are blended together to calculate the overall rate for the class. There are several factors that influence the manual rates. Note that the following is not intended to be an exhaustive list, rather it is a sample of some of the many factors. Also note that the factors used varies between insurance carriers, which means that pooled rates often see far more variance between carriers than experience rated benefits (particularly LTD).

Age

The age of each employee affects their manual rate, with older employees posing greater risk and therefore having higher manual rates. Note that as group benefits are typically sold on a one year renewable contract the rates are reviewed every year, and if nothing else changes in the group all employees will be one year older, thus increasing the pooled rates (presuming no-one has aged past the termination age of each benefit).

Age/Volume distribution

In a group with a flat benefit (for example, a flat $50k life benefit) then all employees have the same volume, and age/volume distribution doesn’t come into play. However, for a group where the volume is based on salary, the age distribution of that volume becomes important.

In an age/volume distribution calculation, a calculation is performed based on how the volume is distributed amongst the group, with higher volumes having a stronger influence on the groups overall rate. This can be particularly impactful if the certs with higher volumes are the older employees, with higher manual rates. Reduction schedules may help by lowering the volumes on older employees.

Gender

The gender of the employees also influences their manual rate. A change in the gender distribution of the group will therefore impact the rates. This can be particularly impactful on small groups, where the loss and replacement of a handful of employees can result in a very different gender distribution.

Occupation

This is particularly important for LTD. Occupation may be factored in at the individual employee level or it may be approximated at the group level (for example the group may be approximately 75% blue collar workers and 25% white collar)

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

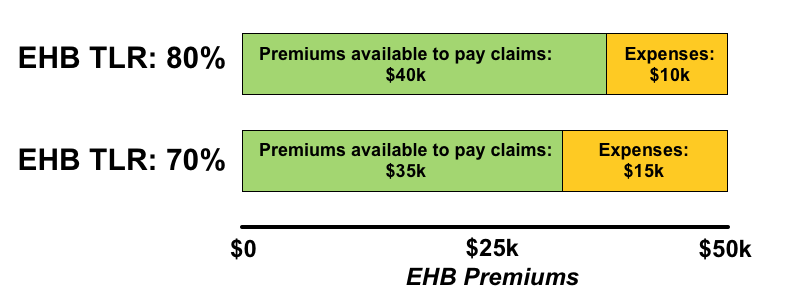

As a group grows they will benefit from economies of scale, which will improve the TLR. A group of 5 members might have a TLR of 65%, which would mean expenses made up 35% of their total premiums. If the group grew to 50 members their TLR might improve to 80%, expenses are now only 20% of premiums. The higher the TLR the better, as it means more premium is available to cover claims.

Plan sponsors should ideally understand TLR’s as it will help to explain renewal increases. For example, if a plan sponsor paid $50k of EHB premiums and the group had $40k of EHB claims, it may come as a shock when the insurance carrier asks for an increase in the EHB premiums. However if the plan sponsor understands that their EHB TLR was 70% then they will understand that only $35k of that $50k was available to cover claims – hence the reason for a renewal increase.

One way to explain TLR to plan sponsors is to use an example they themselves experience. If you consider a persons salary, while on paper they may earn $50,000, this doesn’t mean they have $50,000 to spend. By the time expenses are covered (tax, CPP, EI etc) the amount of money available to spend is reduced. A TLR represents this same concept from the point of view of their insurance premiums, so if the company pays $50,000 in EHB premiums with an 80% TLR, $40,000 is available to cover claims ($50k premiums X 80% TLR= $40k). If the same group had an EHB TLR of 70% then $35k would be available to cover claims. Below is a diagram to highlight the difference:

Because TLR’s determine the amount of premium available to cover claims, they can have a big impact on renewal rates. This is something to pay attention to at quote time, as carriers may be presenting lower premiums, but their TLR may also be lower, meaning that less premium is available to cover claims. This could result in larger increases in future renewals.

As TLR’s are affected by the size of the group they can fluctuate over time, which means they need to be monitored at each renewal and occasionally tested against the market, to ensure they remain competitive.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

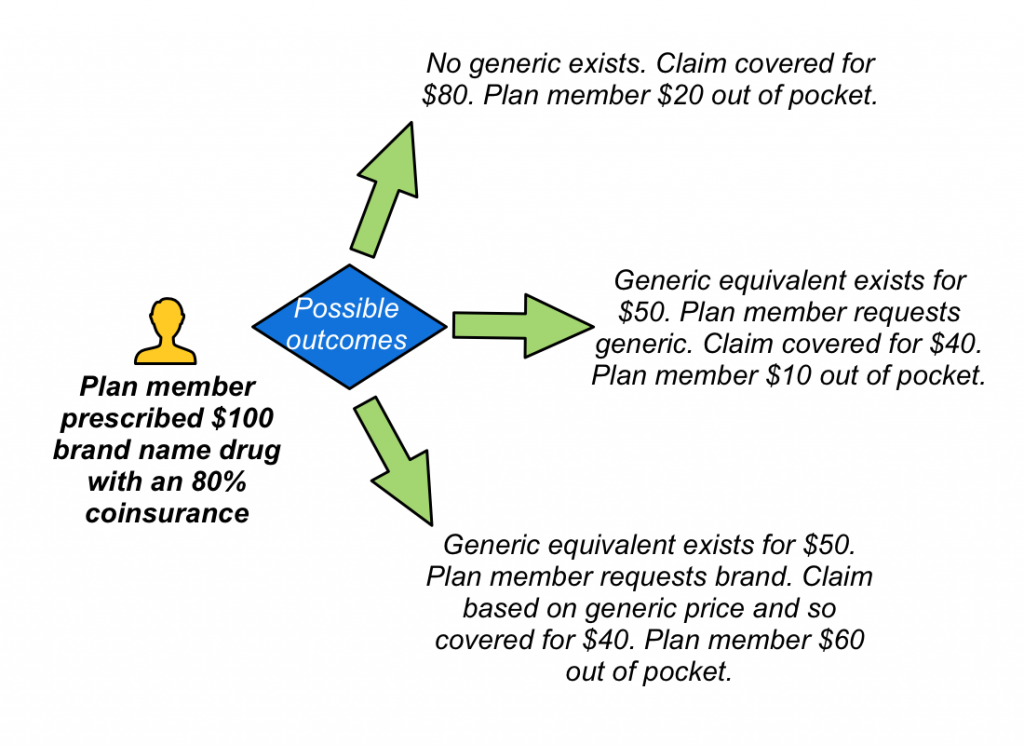

Mandatory generic substitution is an option on the drug plan that controls on what basis a drug claim is paid. In situations where a lower cost generic alternative exists to a brand name drug, the drug plan will only cover the lower cost option. If the plan member insists on purchasing the brand name drug, they will only be reimbursed as if they had opted for the generic equivalent. Note that for a Mandatory generic plan this applies even if the doctor writes ‘no substitution’ on the prescription, unlike a standard generic plan which would pay the brand name drug claim if ‘no substitution’ is indicated.

In situations where no generic equivalent exists, the cost of the brand name drug will be covered up to the limits determined in the plan design. This leaves three possible outcomes:

What is a generic drug?

In Canada, brand-name drugs have a defined duration of patent protection. During that time, only the patent holder can produce the drug. Once the patent expires, other drug companies can apply to produce generic equivalents on that drug. The active ingredients of the generic drug are identical, including purity and dose. The only difference is in the other ingredients such as the dyes and fillers that control the look and shape of the pills.

Generic drugs must go through the same testing as the brand name equivalent to prove they are equally safe and effective. This means that generic drugs are a great alternative. The benefit of generic drugs is that they are often considerably cheaper than their brand name equivalents.

Benefits of Mandatory Generic

Switching a group to Mandatory generic substitution can be a good way to control EHB claims experience. It is protective measure for groups with high or unlimited drug maximums, as these groups pose the greatest risk of very high drug claims. Note that it doesn’t completely eliminate this risk, if an expensive drug has no generic equivalent it will still be covered at the brand amount.

The potential impacts are greater if the plan is switching from a brand name plan. Groups switching from a generic plan will see nominal savings. For experience rated groups, the savings may be greater if existing recurring drug claims will be affected by the change, although this can cause potentially sensitive issues for the plan member(s) affected.

Many plans have a cost sharing of EHB premiums with their employees, so any savings realized will also directly impact the employee contributions. Carriers often have detailed marketing materials on making the switch to mandatory generic, which can be shared with plan members to ensure they are aware of the change and the potential impacts to them the next time they are at the doctors office or pharmacy.

Potential challenges

- Some carriers default to Mandatory Generic if a drug plan is not specified, or may not offer an alternative. When comparing EHB rates, check that everyone has quoted on the same basis.

- If a Doctor prescribes a brand name drug and the plan member is unaware that their drug coverage is mandatory generic, their out of pocket expenses could be very high. Plan members need to be educated to inform their doctors that their plan only covers generic drugs. They can also request a cheaper generic at the pharmacist, even if the doctor has prescribed a brand name drug.

- In rare instances a plan member may have an adverse reaction to the generic equivalent. If this happens the plan member should consult their doctor to see if another generic alternative is available. Many carriers have a process to request a brand name drug for medical reasons. If approved the cost of the brand name drug will then be covered for that plan member.

- Some brand name drug manufacturers offer coupons or reimbursements for plan members that continue to use the brand name drug. It is important to note that if the plan member chooses to continue taking the brand name drug, it is their responsibility to complete the required documentation to submit to these manufacturer reimbursement plans. The groups drug plan will continue to pay up to the generic equivalent.

- Note that the implementation of Mandatory generic substitution may differ from province to province, based on provincial drug coverage and the guidelines in place. These guidelines change over time, so it is important to stay abreast of them to understand the changing impacts on drug claims experience.

Further reading:

Please note these link to external sites:

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Stop Loss works by removing claims that go above the Stop Loss threshold from the clients experience. This helps to protect the client from a wild swing in EHB experience, particularly in the case of smaller groups that don’t have a large number of certificates to spread their experience over.

How does it work?

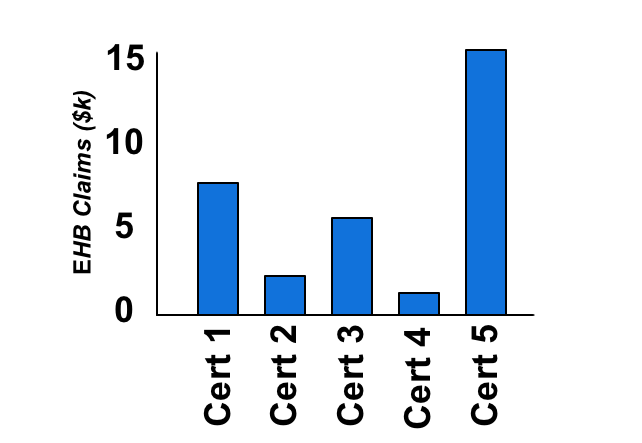

Let’s take a closer look at a sample group:

Imagine that the Group above does not have Stop Loss protection and has hired a new employee (Cert 5). It turns out the new employee is taking recurring drugs that cost $15k a year. As a result of this, at the next renewal the EHB experience has increased dramatically. This small group now faces some difficult choices. They could change their EHB plan design, introducing a drug maximum or higher coinsurance. They could cancel their benefits plan, or the EHB portion. They may even consider letting Cert 5 go. All of these options cause new problems.

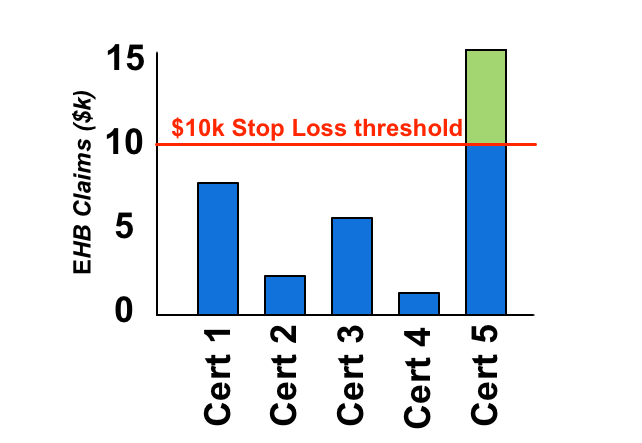

Now consider the same group with Stop Loss protection:

Once the certificates claims reach the Stop Loss threshold, they are removed from the clients experience, or in the case of an ASO group the claims are no longer the policy holders responsibility. Note that the claims could continue into the hundreds of thousands, and the client would still only pick up the claims below the Stop Loss threshold. Even better, the same thing will happen every year, so even if the claims are recurring the Stop Loss will keep those claims out of the EHB experience (presuming the offered Stop Loss includes recurring claims, which most do).

Stop Loss charges

Stop loss has it’s own separate charge, which can either be a flat $ amount, a flat % amount or an experience rated % amount. Lower Stop Loss thresholds represent a higher risk to insurance carriers and so will come with higher charges. There may be a choice of multiple Stop Loss thresholds, each with their own costs. Note that sometimes higher Stop Loss thresholds are not offered to smaller groups, as carriers do not want them to take on too much risk. Clients may sometimes question why they are being charged for Stop Loss coverage, or why the Stop loss charge has increased, when they have no claims over the Stop Loss. The amount charged is dependant on many factors, including how the Carrier breaks out their Stop Loss pools and the experience of those pools, which new high cost drugs are coming onto the market and a variety of other components. The way stop loss charges are presented differs from carrier to carrier, with some bundling other items into the charge, making an apples to apples comparison more challenging.

Things to watch out for

Not all Stop Loss coverage is created equal. There are various elements that can differ, from what is pooled (drugs vs all of EHB) to how the claims are pooled (per certificate or per insured) to whether or not recurring claims will be pooled. The latter is still a fairly new option, it is considerably cheaper but doesn’t provide as robust protection against recurring high claims.

EP3 Stop Loss

EP3 is a type of stop loss, although a very specific type that is compatible with the CDIPC Industry Pooling initiative. From your clients point of view an EP3 operates almost exactly the same as a traditional stop loss, but do double check how the carrier treats employees not eligible for EP3 coverage, as they will require a separate Stop Loss mechanism in place. The pooling of claims from EP3’s into the wider Industry claims pool is purely a reinsurance mechanism and has no direct impact on your client.

Did we miss anything? Please let us know in the comments below.

]]>