Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Some of the topics that are often covered by EAP’s are:

- Workplace stress

- Substance abuse or smoking cessation

- Disability support

- Grievance counselling

- Relationship issues

- Financial advice

- Legal advice

- Advice for managers on employee situations

Everything discussed with the EAP provider is strictly confidential and is free for the employees and their immediate family to use. The separation of the EAP provider and the employer is a key component of the benefit, enabling employees to talk openly about issues that they may not be comfortable discussing with their employer for fear or reprisals.

The focus of an EAP program is on employee wellness and in being proactive, resolving problems before they impact work performance. The nominal cost is potentially offset by a reduction in absenteeism and turnover, faster recovery and less burden for managers and/or HR. The key is in making employees aware of the EAP program and all that it offers through regular employee communications and information sessions. Under utilization of the EAP benefit is usually due to a lack of awareness of the services available.

.

How does an EAP work?

The initial point of contact with the EAP provider is via a phone call using the number provided. The employee or a member of their immediate family calls this number within the hours of operation (typically 24/7) and speaks to a phone agent that helps them determine the nature of their problem. The agent will either then proceed with the call (if it is within their area of expertise) or refer the caller to an appropriate resource that is suitably trained to handle the issue. A call back time or face to face meeting may be scheduled if no suitable resource is currently available.

.

Options

There are limited options to choose from for most EAP benefits. If there are options they typically centre around the level of EAP services provided, for example whether face to face EAP consultations are available. There may also be choices around the different categories the EAP covers, with topics such as legal advice or financial advice constituting optional extras.

.

Rates

EAP is usually priced on a flat per employee basis. The rate may be bundled with other products (such as EHB or LTD) or sold separately.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

It is important to stress that Out of Country is not the same as trip insurance. It only covers medical emergencies and will not pay for cancelled flights, hotel stays as a result of delays or lost luggage. The definition of ‘medical emergency’ varies from carrier to carrier, but it typically means unexpected illnesses or accidental injuries. There may be pre-existing condition exclusions. It is important to review the conditions of your out of country coverage before heading overseas as resolving issues while someone is out of the country can be extremely challenging.

Out of Country components:

Unlike other group benefits, there are relatively few choices regarding Out of Country, with each carrier offering a limited selection of options. However, there are components that should be compared between each carriers OoC offering as these variables can have a significant effect on the coverage available:

.

Number of days covered:

There may be a choice regarding the number of days the out of country benefit covers, but even a standard offering will cover the vast majority of trips. Between 60 and 120 days is the usual amount of days covered. Note that these are typically consecutive days (not annual limits) but there may be rules around what constitutes a continuation of the same journey. For example, returning to your home province for 24 hours but then leaving again may be considered a continuation of the previous trip.

Note that both business and personal travel is covered, and if you have family OoC coverage your eligible dependants are likely also covered under your OoC benefit.

Typically the only employees that run the risk of exceeding the number of days trip limit is business owners that are snow birds (i.e. living overseas for extended periods during the Winter). These employees should confirm that their OoC coverage will cover the duration of their time overseas or purchase additional insurance to fill any gaps in coverage.

.

Students studying overseas:

Extended OoC coverage may be available for students that are studying overseas, but these are typically considered on a case by case basis. Approval should be confirmed with the groups insurance carrier before the student leaves the country. Restrictions often apply, for example coverage may only apply while the student is studying and may not cover any travel they do before or after their courses. There may also be restrictions around which educational institutions and/or countries are covered. It is worth stressing again that the Out of Country benefit only covers medical emergencies.

.

Lifetime Maximum:

Out of country typically operates on a lifetime maximum basis. These maximums can be extremely high (in the millions of dollars) or sometimes even unlimited. Note that there may be other restrictions or limitations regarding what is and isn’t covered, and for how much. It is worth comparing the specifics of each carriers offerings to understand which would provide the most comprehensive coverage.

.

Termination Age:

The age at which employees are no longer covered by the OoC benefit. 75 is the standard OoC term age, but some carriers may offer a higher termination age or a choice of OoC termination ages, with higher OoC rates for older employees.

Note that as with other benefits the Termination Age is applied to the employee. Dependant spouses that exceed the termination age remain covered as long as the employee is under the termination age. This can be particularly important for OoC coverage.

.

Travel Assistance:

The Out of Country benefit often includes a travel assistance portion, which assists employees that are injured or sick while overseas. This assistance can include everything from locating appropriate care facilities nearby, pre-paying medical bills or helping to rearrange transport back to Canada.

It is highly recommended that employees contact the travel assistance provider as soon as possible once a claim incidence has occurred, to help ensure that the claims process is a smooth one for all parties. The number is usually found on the employees benefit card.

.

Coinsurance & Deductible:

As Out of Country coverage is intended to cover emergencies only (ie not a planned spend) they usually have 100% coinsurance, meaning the claimant is not expected to cover any % of the overall costs. For the same reason OoC usually has a $0 deductible.

.

Rates:

Out of Country rates are most commonly based on a flat amount, with certificates with single coverage paying around half as much as those with family coverage. OoC is not an experience rated benefit, it is a pooled benefit. However unlike other pooled benefits OoC is pooled from first dollar, meaning that all claim amounts are pooled and none of the cost is passed on to the policyholder.

.

.

Key Provisions:

- Pre-existing condition/Stability clause: Out of Country is intended to cover unexpected medical emergencies. For this reason there is typically pre-existing conditions or stability clauses in the OoC benefit. These can limit or prohibit OoC claims related to a known medical condition. For example, if an employee had a heart attack, and 2 weeks later went overseas on holiday and had another heart attack, this is unlikely to be covered by the OoC benefit due to this clause. This does not mean that this employee could not claim for a different medical emergency, nor does it mean they can never claim for heart related conditions again – the stability clause will outline how long an employee must be symptom and treatment free before their condition is considered ‘stable’.One common ‘condition’ caught up in the pre-existing clauses is pregnancy. There are often guidelines around at what point in a pregnancy Out of Country would no longer cover the birth of the child. This is a particularly important provision to understand as the cost of delivering and caring for a premature child while overseas can run in to hundreds of thousands of dollars.

- High risk activities: Another common exclusion is activities deemed to be high risk. A full list of these will be included in the OoC contract, but common exclusions include heli-skiing, motor sport racing or competitive sports that you are paid to compete in.

Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Paramed components:

There are many components of Paramed coverage. The following is not intended to be an exhaustive list, rather these are the most common components:

.

Paramed practitioners:

A choice is offered as to which paramed practitioners will be covered by the plan. There are a wide variety of paramed practitioners to choose from, although it is not as simple as just selecting the desired practitioners. Often there are additional requirements, for example practitioners may be required to be licensed, certified or registered.

Typical practitioners to choose from include:

- Acupuncturist

- Audiologist

- Chiropractor

- Chiropodist

- Dietician

- Naturopath

- Occupational Therapist

- Osteopath

- Physiotherapist

- Podiatrist

- Psychologist

- Registered Massage Therapist

- Social Worker

- Speech Therapist

.

Coinsurance:

How much of the cost of the practitioner is covered by the employer. Lower coinsurances (for example 50%) create more out of pocket expenses for employees, but may also help to reduce utilization and/or fraudulent claims.

.

Maximum:

There are several different ways the paramed maximum can be calculated. The calculation you choose will depend on the level of cost containment desired. Here are some of the available options:

- Per Certificate, per practitioner: This option combines the claims experience of everyone under one certificate (employee + spouse + dependants) on a per practitioner basis. For example, if there was a $300 maximum in this scenario, if one family member claimed $300 of physio then no other members of that certificate could claim physio until the next benefit period. They could however claim for a different practitioner, for example a speech therapist.

- Per Insured, per practitioner: This option provides a separate maximum for each member under one certificate (employee + spouse + dependants) on a per practitioner basis. For example, if there was a $300 maximum in this scenario, each member of the family could claim up to $300 of physio per benefit period. This option creates the greatest opportunity for risk.

- Per Certificate, All practitioners combined: This option combines the claims experience of everyone under one certificate (employee + spouse + dependants) and across all practitioners. It therefore is the option with the lowest risk (although this may not be true if a higher overall maximum is used). For example, if there was a $500 maximum in this scenario, once the combined claims of all family members reaches $500, no additional parameds can be claimed until the next benefit period.

- Per Insured, All practitioners combined: This option combines the claims experience of all practitioners for each individual member of the certificate. For example, if there was a $500 maximum in this scenario, one family member reaching the $500 maximum across all practitioners has no bearing on the other family members ability to make paramed claims.

- Maximum per visit, per insured: This option can often be used in conjunction with one of the maximums selected above. It further restricts paramed coverage by capping the amount that can be claimed per visit. For example, if this maximum was set to $100, then an insured is only reimbursed up to $100 per visit, even if the amount of the claim is higher. There is often an option to differ the maximum amount by practitioner.

.

Referral required:

If this option is selected then insureds need to get a referral from their physician before they can make a paramed claim. This option is most often applied to massages. There is some debate as to how effective a deterrent this is.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

The Critical Illness benefit is designed to reduce the financial strain for employees, allowing them to focus on their recovery.

Critical Illness Components:

There are many components of the Critical Illness benefit. The following is not intended to be an exhaustive list, rather these are the most common components:

.

Covered Conditions:

The number of conditions that are covered by the Group CI benefit. The list of covered CI conditions continues to increase, with carriers regularly adding more conditions. Note that 85%+ of all CI claims will fall under a very small subset of CI conditions, stroke, heart attack, cancer and coronary artery bypass surgery. Plans covering more conditions may appear to be offering greater protection, but these may come at the cost of more stringent pre-ex requirements or lower NEM‘s.

Note that some Group CI plans will cover dependants, either spouse, children or both. It is not uncommon for the list of conditions covered to differ for children.

.

Lump Sum Amount:

The $ amount paid to the employee when they are diagnosed with a covered condition and all the other criteria are met. The lump sum payment is tax free and there are no restrictions on how it is used. It does not have to be spent on medical expenses, for example the employee could choose to spend it on a family vacation or use it to pay off existing debts.

..

Termination Age:

The age at which the Critical Illness benefits cease to be paid. 70 is a commonly used termination age for CI, although higher termination ages may be available depending on the carrier.

.

Reduction Schedule:

Similar to the Group Life benefit, Group CI often has a reduction schedule, meaning that the amount of coverage provided decreases once an employee reaches a certain age. For example, the benefit may drop by 50% once the employee reaches age 65, meaning if the lump sum benefit is $50k, an employee over 65 that has an approved CI claim would receive $25k.

.

Pre-existing Condition Guidelines:

Group CI pre-existing condition (pre-ex) guidelines are typically expressed in two numbers, separated by a /, for example 12/12. A 12/12 pre-ex means that any CI claim within 12 months of the effective date would not be paid if the employee had sought medical attention or had symptoms related to said condition at any point during the 12 months prior to the effective date. Pre-ex exists to prevent employees from seeking Group CI coverage when they know or suspect that they may have a critical illness. Longer pre-ex periods provide greater protection from anti-selection and will help lower the cost of the Group CI benefit.

.

Partial Payment:

Some Critical Illness plans offer a reduced lump sum payout if an employee is diagnosed with a condition on the partial benefits list. These often include early diagnosis of cancer. Claiming a partial benefit does not typically effect your ability to make a full CI claim down the road if your are later diagnosed with a condition on the lump sum payment list.

.

Multiple Payments:

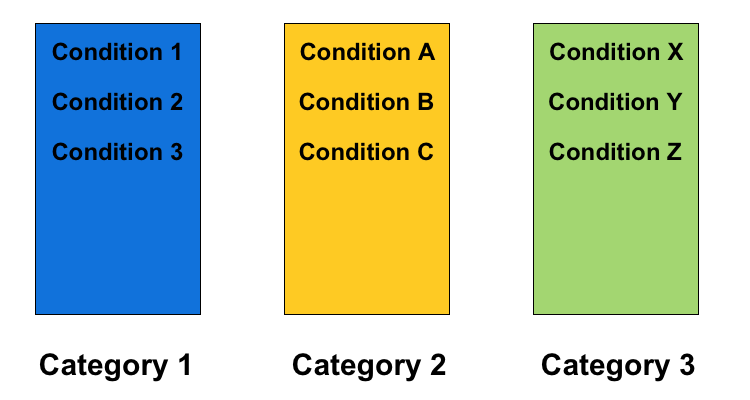

Some Critical Illness plans will pay for more than one CI claim. Do be aware though that restrictions apply. You can’t claim the same condition twice, for example if you had a heart attack and later had a second heart attack (although see below regarding cancer). In addition to this, conditions are usually classified into categories or groups, and it is not possible to claim multiple conditions from the same category.

For example, if an employee was diagnosed with Condition A from the chart above and received a full payout, and was later diagnosed with Condition B, they would not be eligible to receive the second payout as both conditions are in the same category. However, if they were diagnosed with Condition Z, that is in a different category and the second claim would be eligible.

Note that the number of categories and which conditions are in them can differ between insurance carriers.

.

Cancer Recurrence:

Some Critical Illness plans will pay for more than one cancer CI claim. This may be treated differently from the regular multiple payments detailed above. There are usually clear guidelines as to how and when multiple cancer claims would be eligible, for example, after 5 years treatment free.

.

Benefits of Critical Illness

- You’re helping employees when they need it most: Being diagnosed with a serious condition is stressful enough, without having the added burden of day to day finances. Knowing that they have Group CI coverage can help provide peace of mind for all employees.

. - The benefit is extremely flexible: The employee can choose how best to spend the lump sum payment, based on their individual circumstances, making Group CI a very flexible way to provide support.

.

Potential challenges

- Understand the restrictions: Different carriers will cover a variety of conditions for CI, some up to 40 different conditions. Note that the number of conditions is not as important as the restrictions around those conditions. More important than the number of conditions are the restrictions placed on CI coverage, for example:

- Pre-ex requirements: See above. Longer pre-ex periods can make it harder to make a claim.

- Survival period: How long the employee must survive before the lump sum payment is paid out.

- Non-evidence maximums: How much coverage is available without medical evidence. More details on NEM’s can be found here.

.

- Moving groups with Critical Illness: Group CI benefits have a lot of behind the scenes rules and guidelines that can vary significantly from carrier to carrier. Be especially aware when moving a group with CI from one carrier to another, as employees that may have previously been eligible for coverage may no longer be covered due to the new carriers restrictions, condition categories etc. Be sure to check what (if anything) will be covered by grandfathering. For example, what is the impact on an employee halfway through their pre-ex period when the group transfers?

Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

HCSA Components:

There are many components of the HCSA benefit. The following is not intended to be an exhaustive list, rather these are the most common components:

.

HCSA amount:

The amount of money available under the Healthcare Spending Account. Note that this amount can differ by class.

.

Benefit period:

Whether or not the HCSA period is based on a benefit year (ie the 12 months from when the group benefits plan renews) or a calendar year basis (1st Jan – 31st Dec).

.

Allocation period:

How the HCSA amount is made available. This could be annually (ie the full amount right away) bi-annually (half now, the other half in six months) or even quarterly. The allocation period can help to control risk in classes with high turnover, avoiding the situation where employees with short tenure max out their HCSA allowance before they leave.

.

Pro-rate new employees:

Determine whether employees joining partway through the year get the full HCSA amount or a pro-rated amount (for example an employee joining six months into the benefit period would receive 50% of the HCSA amount for the remainder of the benefit period)

.

Balance Carry Forwards:

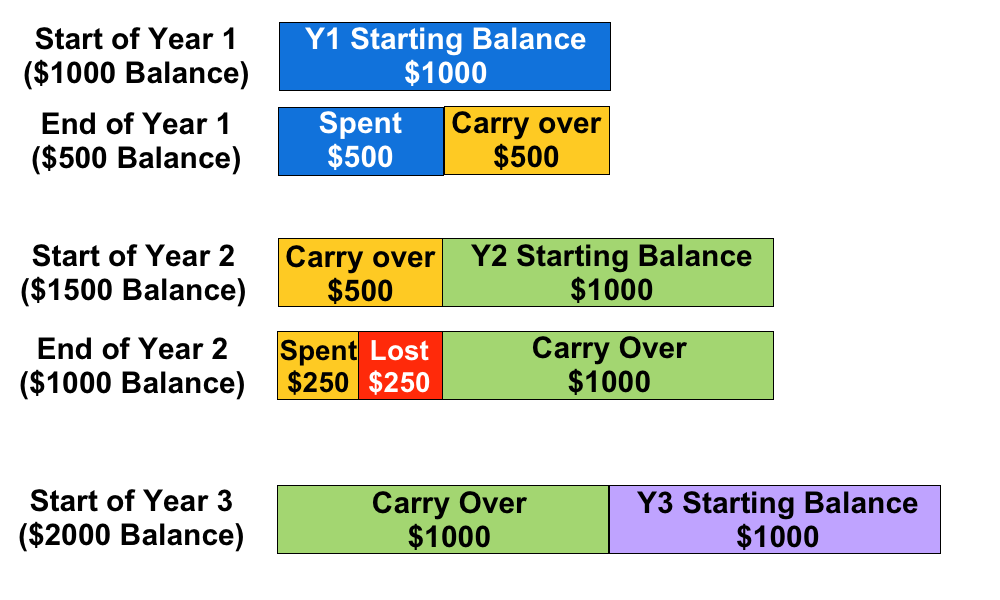

This determines wether or not employees can carry their remaining HCSA balance from one year to the next. This is typically restricted to one year only. The carried over balance is used to cover claims first, before the new balance is used.

For example, if an employee has a $1000 annual HCSA allocation and they only use $500, the next year they will have $1500 available in their HCSA. However, if they only use $250 in the second year, they can only transfer $1000 to Year 3, even though $1250 is remaining in their HCSA. Note that the remaining $250 is forfeit, it cannot be paid out to the employee.

.

.

Benefits of a HCSA

- They are flexible: The money can be spent on anything that is deemed an eligible expense. This avoids a situation where employees maxes out their coverage in one area of the plan, but still has a lot of unused coverage in other areas (this is common with items such as paramedical practitioners)

- They help prevent employees being out of pocket: Deductibles, dispensing fees and other out of pocket expenses from the regular benefits plan can be claimed under a HCSA.

- Tax advantages: HCSA claims are a tax deductible business expense, and the benefits are received tax-free, provided the HCSA is 100% employer paid. Unused HCSA amounts cannot be paid out at year-end as cash to the employees, any unused amounts that are not eligible to be carried forwards are forfeited by the employee.

- Employees can save up for larger expenses: If an employee has expensive treatment that can be scheduled, such as laser eye surgery, they can take advantage of Barry Carry Forwards to maximize how much they can claim using their HCSA.

.

Potential challenges

- There is no way to limit what the HCSA is used for: Provided the claim is deemed eligible under the guidelines there are no other restrictions placed on what can be claimed under the HCSA. The guidelines may be broader than a traditional benefits plan.

- HCSA’s are an ASO benefit: This means the employer is entirely responsible for covering every dollar spent under an ASO, along with any applicable administration fees. Combined with the point above, make sure your plan sponsor is able to cover the costs if a large % of employees use most of all of their available HCSA amounts (taking into account the additional risk of Balance Carry Forwards). While this scenario is unlikely, making sure the plan sponsor is prepared for it will help to avoid any unpleasant surprises.

- May create cash flow fluctuations: It is important to check the ASO funding model being used by the HCSA benefit. ‘Pay-as-you-go’ is a popular model, meaning the plan sponsor is responsible for the HCSA claims almost immediately. This can create large fluctuations in benefit costs month to month.

Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

The dental procedures that are covered vary greatly depending on the levels of Dental covered under the plan.

Dental Levels

Dental is typically split into four levels:

- Basic Restorative: This covers diagnostic and preventative treatments, such as cleanings, scaling of teeth, dental examinations, x-rays, oral hygiene, fillings and tooth extractions.

- Periodontic-Endodontic: Includes periodontic services to treat the bone and gum around the tooth and endodontic services.

- Major Restorative: This covers crowns, dentures, inlays, onlays and bridgework. Other more extensive dental may also be covered, including major dental surgery and root canals.

- Orthodontic: This covers appliances such as braces, wires, spacers and other dental aids used to straighten teeth or correct other problems. Pre-approval is often required before proceeding with Orthodontic work. Orthodontics often has a higher co-insurance and a lifetime maximum (as opposed to an annual maximum). One other choice to be made is whether or not to extend Orthodontic coverage to adults or only to child dependants.

.

Dental components:

There are many components of the Dental benefit. The following is not intended to be an exhaustive list, rather these are the most common components:

.

Funding model:

Due to it’s relatively low risk of extremely high claims and fairly stable experience, Dental is often a strong candidate for the Administrative Services Only (ASO) funding model. ASO means that the client takes on the full risk of claims payment themselves and pays the insurance carrier a small administration fee per claim. This mitigates the risk of the policy owner overpaying for their Dental benefit, for example if Dental claims were lower than anticipated and were considerably less than the Dental premium paid. However it also means the client is fully responsible if Dental claims are higher than anticipated.

.

Scaling Units

Scaling units are a measurement of time spent scaling the teeth to remove plaque. These units are measured in 15 minute increments. When employees go to the dentist for their regularly scheduled cleanings, this is typically when scaling units are used, with multiple scaling units charged per visit (typically 2-3, depending on how long was spent scaling the teeth).

Scaling units often have their own maximum as part of the plan design, for example 12 scaling units per period. It is important for employees to know the scaling units maximum on their plan, and also how many scaling units the dentist is charging per visit, to ensure they aren’t left with an expensive out of pocket charge.

.

Recall period:

This determines the length of time required between regularly scheduled dental visits. The most common recall period is 6 months, but 9 or 12 months are also available. Longer recall periods reduce the cost of the dental benefit.

.

Coinsurance:

Coinsurance defines what % of a dental claim the insurance carrier will pay. Lower coinsurances leave the employees covering more of the cost, which reduces the dental claims experience and lowers the dental rates. Note that unlike deductibles, coinsurance continues to be paid for every dental claim, there is no annual limit on the out of pocket expenses for the employee.

.

Deductible:

This works the same way as other insurance deductibles, it is an annual out of pocket expense that the employee must satisfy before a dental claim is paid. Deductibles are different for single and family certs, for example the single deductible may be $50 and the family deductible may be $100. Deductibles are reset every 12 months.

For groups switching carriers late in the calendar year it is often worth getting a report of which employees have satisfied their deductibles, or if such a report is not available asking the new carrier to waive deductibles for all employees for the remainder of the year. This ensures employees are not being penalized by a change in carriers.

.

Maximum:

The maximum $ amount that will be paid out over a 12 month period. There are separate maximums for each level of dental, with options to combine level 3 dental with levels 1&2 to better control costs. Level 4 dental has a lifetime maximum as opposed to an annual max. There may also be a choice for the maximum to be calculated per certificate (ie employee and all dependants combined) or per insured (each family member gets their own maximum).

.

Waiting Period:

The Dental waiting period determines the length of time a new employee must wait before their dental coverage becomes activate. Longer waiting periods can be used in high turnover classes to help reduce the risk of new employees gaining employment solely to utilize the dental benefit. Note however that longer waiting periods can make things difficult for new employees that had dental coverage at their previous employer and now find themselves without dental coverage for an extended period of time.

.

Termination Age:

The age at which the Dental benefits cease to be paid. 75 is the standard Dental term age, but several carriers will allow Dental coverage up to age 85 or even beyond.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Life components:

There are many components of the Group life benefit. The following is not intended to be an exhaustive list, rather these are the most common components:

Volume:

How much the beneficiary is paid in the event of the employees death. There are two different methods for calculating the Group Life volume:

- Flat amount: Everyone in the class receives the same amount of Life benefit, regardless of their salary. There is typically a minimum amount of flat life insurance that the insurer will require, usually around $20k.

- Salary based: A multiple of the employees salary is used to calculate the amount of Life insurance. One or two times salary are the most common multiples. Note that the maximum amount would still apply (see below) so the actual benefit payment may be capped.

Group Life benefits often have a graded schedule, which means the volume is reduced once the employee reaches a certain age. For example, the life benefit may reduce 50% at age 70, or drop to a certain flat amount. There can be more than one reduction, for example, a reduction at age 70 and a further reduction at age 75. Employees typically require less life insurance as they get older, as expenses such as mortgages and children’s education are often paid off at this point. Having a graded schedule also helps to keep the rates down for Group Life. As Life is a pooled benefit the rates are calculated using an age volume distribution, which means having less volume on older employees helps to control the overall rate for that class.

Termination Age:

The age at which the Group Life benefit ceases to be paid. 75 is a common Group Life term age, but there is a great deal of flexibility regarding how high the termination age goes for Group Life, particularly if there is a reduction schedule. Note that the employee still needs to meet the plans eligibility requirements, for example they still have to be working the required number of hours.

Non-Evidence Maximum:

The Non-Evidence Maximum (NEM) is the amount of Group Life coverage a carrier will automatically provide to all employees that are eligible. Any Life coverage in excess of the NEM will typically need to be medically underwritten on an employee by employee basis. Higher NEMs are therefore a benefit to the client as it will reduce medical underwriting. The size of the group and the average Life amount are the two factors typically used by insurers to determine the Life NEM, with larger groups and higher average Life amounts receiving larger NEMs.

The NEM is a major advantage of Group Life insurance over Individual life insurance. Because of the NEM, employees that would be ineligible for Individual life coverage for health reasons can still get Group Life coverage up to the Non-Evidence Maximum.

Maximum:

The maximum amount of Life benefit that will be paid out. This number only affects employees with Life volumes above the maximum. For example, if the Life volume is 2X salary and the maximum is $100k, then someone earning $40k a year won’t be affected by the maximum, but someone earning $55k would be (they would lose $10k of Life benefit).

The maximum is commonly applied to the Basic and Optional Life amounts combined.

Rates:

Rates for Group Life are expressed per $1,000 of volume. For example, if the life rate was $0.20/$1000 and an employee had a flat $50,000 life benefit, then they would pay $10 a month for their life coverage (($50,000/1000) * 0.2 = $10)

While everyone in the same class pays the same rate, the monthly amount they pay will differ if the volume is salary based.

Premiums for Group Life can be covered by either the employee or the employer.

.

Dependant Life:

While technically a separate benefit, the core concept is the same, only reversed. In the event that an employees dependants pass away, a small benefit is paid to the employee. Dependant Life is always a flat benefit, with a common setup being a benefit amount for the spouse or common law partner and half as much for any children that meet the definition of dependant. For example, the spouse may be covered for $10k and the children for $5k each. It is rare to see large Dependant Life volumes, the intention is to provide assistance with costs such as funeral expenses.

.

Optional Life:

Optional Life can be extended to the employees of a Group Life plan. Optional Life is purchased by the employees in addition to the Group Life coverage provided by the plan. Each employee can choose how much (if any) Optional Life to purchase. The key difference is that medical underwriting is usually required for all Optional Life, and Optional Life coverage is always paid for by the employee, not by the employer.

Optional Life may not be the best choice for employees looking to provide adequate life coverage as it is often not portable, meaning if the employee goes to work somewhere else they may not be able to bring their optional life coverage with them.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

AD&D Components:

There are many components of the AD&D benefit. The following is not intended to be an exhaustive list, rather these are the most common components:

Volume:

AD&D volume typically matches the life volume for the group plan, so for example if Life is 2x salary then AD&D would be too. Note that in the event that an employee is killed in an accident the AD&D benefit is paid out to the employees designated beneficiary in addition to the life benefit, effectively doubling the amount paid.

A percentage of the AD&D volume may be paid out in the event an employee is dismembered but not killed. The exact percentage and definition of dismemberment is determined by the AD&D contract. In this scenario the benefit is paid directly to the employee.

Termination Age:

Determines the age at which the AD&D coverage ends. This typically matches the Life benefit termination age.

Dismemberment Definitions:

Behind the scenes of an AD&D plan is a list of definitions regarding what is covered and how much is paid. For example, a fraction of the full AD&D volume may be paid out if an employee loses a thumb in an accident, or half may be paid out in the event of losing a limb. There will also be a detailed definition of what constitutes each loss, for example losing an arm may be defined as the removal of the entire arm up to the shoulder joint. Sight, hearing and speech are also typically covered, for example the full AD&D benefit may be paid in the event an employee loses their sight in an accident.

Additional coverage:

AD&D benefits may include additional coverage, for example paying for rehabilitation, repatriation in the event an accident occurs overseas or covering day care costs while an employee is recovering. Home or vehicle alteration costs may also be partially covered. Sometimes this additional coverage is included automatically and other times they are optional extras. It is worth reading the fine print to fully understand what is covered.

Common Exclusions

Due to the required accidental nature of the AD&D benefit there will be clear exclusions as to what is not covered. For example death due to illness, suicide, war injury or natural causes are likely to be exempt under the AD&D benefit. Other exemptions may apply if the employee was under the influence of alcohol or non-prescription drugs when the accident occurred.

AD&D benefits may take longer to pay compared to other benefits such as Life as often investigations will need to be completed before the benefit can be paid. For example an autopsy or police report may be required to determine the cause of the accident.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

An advantage of incorporating STD into a clients benefits plan is that it allows the disability claim to be assessed and managed by the insurance carrier earlier in the process, which may help to return employees to work faster and reduce Long Term Disability (LTD) claims.

STD plan designs are sometimes expressed in a shorthand containing accident & hospital elimination period (in days), followed by sickness elimination period (in days), followed by benefit duration (in weeks). This looks like 0/7/17 or 0-7-17.

STD components:

There are many components of the STD benefit. The following is not intended to be an exhaustive list, rather these are the most common components:

Volume:

How much the employee is paid while they are off on disability. 70% is a typical amount. Amounts above 75% are typically considered higher risk unless the benefit is taxable, as the employees income will be comparable to when they were working, making it more difficult to return them to work.

Taxable Benefit:

Whether or not the benefit payment amount is taxed. This can have a major impact on the amount of the weekly benefit the employee receives. If the employer contributes anything to the STD premium payments the benefit is automatically taxable.

Termination Age:

The age at which the STD benefit ceases to be paid. 65 is the standard STD term age, but unlike LTD the STD term age can go higher than 65.

Elimination Period:

The STD Elimination Period is actually broken out into several components, with varying elimination periods based on the reason that the employee is off work. Absence due to an accident, hospitalization or surgery typically have shorter elimination periods, as low as the 1st day (expressed as 0 days), but as long as 15 days. On the other hand absence due to sickness typically requires an employee to be absent for 8 to 15 days before the STD benefit kicks in.

Non-Evidence Maximum:

The Non-Evidence Maximum (NEM) is the amount of STD coverage a carrier will automatically provide to all employees that are eligible for STD. Any STD coverage in excess of the NEM will typically need to be medically underwritten on an employee by employee basis. Higher NEMs are therefore a benefit to the client as it will ensure more employees in the group have adequate STD coverage. The size of the group and the average STD amount are the two factors typically used by insurers to determine the STD NEM, with larger groups and higher average STD amounts receiving larger NEMs.

Maximum:

The maximum weekly amount that will be paid out. This number only affects employees who’s volumes are above the weekly maximum. For example, if the benefit is 70% and the maximum is $1000 a week, an employee earning $1000 a week would receive $700 of weekly benefit. An employee earning $2000 a week would be eligible for $1400 but would only receive $1000 due to the STD maximum.

Benefit Duration:

This determines how long the STD benefit will continue to be paid. The three most common STD durations are 15 weeks (to align with EI), 17 weeks and 26 weeks. For groups that also have LTD it is standard to align the STD duration and the LTD elimination period, to ensure there is no gap in an employees disability coverage.

E.I. Integration:

Employment Insurance is a viable alternative for groups that don’t have STD coverage. In cases where STD coverage is in place, E.I. takes the position of second payer, with EI being reduced on a dollar for dollar basis against the STD benefit. E.I payment lasts for 15 weeks and doesn’t kick in until the 15th day of an employees absence.

Employers that opt to provide STD that is at least comparative to E.I. can receive a reduced E.I. premium rate, as the STD benefit will cover employees off work for the short term.

Previous STD Claims Experience:

STD is an experience rated benefit, meaning that the groups previous claims experience for STD will have an impact on the future STD rate. How much of an impact depends on the size of the group and the credibility factor applied by the insurance carrier. Larger groups typically have higher credibility, and therefore their previous STD claims experience will have a more significant impact on the STD rate. Sometimes more than one years STD experience will be used in the calculation. It is common for different years to be given different weightings in the calculation.

]]>Notice: compact(): Undefined variable: limits in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

Notice: compact(): Undefined variable: groupby in /hermes/bosnacweb08/bosnacweb08ag/b1302/nf.pillowponcho/public_html/wp-includes/class-wp-comment-query.php on line 853

The LTD benefit may be considered less important by employees than a high utilization benefit such as Drugs or Dental coverage, but it is instrumental in protecting the long term financial wellbeing of employees.

LTD components:

There are many components of the LTD benefit. The following is not intended to be an exhaustive list, rather these are the most common components:

Volume:

How much the employee is paid while they are off on disability. 66.67% of their pre-disability earnings is a typical amount. Higher salary %’s create higher risk, as the disabled employees income on disability will be comparable to when they were working (particularly if the benefit is non-taxable), which potentially makes it more difficult to return them to work.

Graded schedules can also be used to calculate an LTD volume. These are useful for classes of high income employees as they help to avoid a situation where an employee is paying for LTD amounts that they may not be able to receive due to the all source maximum (see below).

Note that other sources of income may be included in the volume calculation upon request. These can include annual bonuses, commissions and dividends. There may be additional terms and conditions when including these sources, for example if commissions are included the amount may be calculated using an average of the previous 2 or 3 years commissions, to help to smooth out any variability.

Taxable Benefit:

Whether or not the LTD benefit payout amount is taxed. This can have a major impact on the amount of the monthly benefit the employee receives. Note that if the employer pays any portion of the LTD premiums then the LTD payment is automatically taxable.

Termination Age:

The age at which the LTD benefit ceases to be paid. 65 is the standard LTD termination age. Note that many carriers will terminate LTD coverage when an employee reaches age 65 minus the elimination period, so that the employee is not paying for an LTD benefit they will never be able to claim.

Elimination Period:

How long an employee has to be unable to work until the LTD benefit starts to provide payments. This number is expressed in weeks. 17 weeks is the most common option as this integrates with Employment Insurance (EI). If the group also has Short Term Disability it is standard practice to align the LTD elimination period with the STD Benefit duration to ensure there is no gap in coverage.

Non-Evidence Maximum:

The Non-Evidence Maximum (NEM) is the amount of LTD coverage a carrier will automatically provide to all employees in the group that are eligible for LTD. Any LTD coverage in excess of the NEM will typically need to be medically underwritten on an employee by employee basis. Higher NEMs are therefore a benefit as it will ensure more employees in the group have adequate LTD coverage. The size of the group and the average LTD coverage amount are the two factors typically used by insurers to determine the LTD NEM, with larger groups and higher average LTD coverage amounts receiving larger NEMs. Note that some carriers may base their NEM’s on the number of employees with LTD, rather than the overall size of the group.

Maximum:

The maximum monthly amount of LTD benefit that will be paid out. This number only affects employees who’s volumes are above the monthly maximum. For example, if the benefit is 66.67% and the maximum LTD benefit is $1500 a month, an employee earning $20k a year would receive around $1100 of monthly benefit and would see no impact from the LTD maximum. An employee earning $50k a year would be eligible for almost $2800 a month of LTD benefit, but would only receive $1500 due to the LTD maximum.

Own Occ Period:

Initially an employees definition of disability will be based on their own occupation (own occ). At the end of the own occ period, if the employee is still disabled their claim will be reassessed based on their ability to do any occupation. Conditions apply, for example the occupation must be one that the employee is reasonably qualified to perform by education, training or experience. 2 years is the standard Own Occ period. 5 years and to age 65 own occs may also be available upon request, but longer own occ periods increase the risk exposure of the group and so may come with an increased rate or may not be available to all industries.

Benefit Duration:

This determines how long the LTD benefit will continue to be paid. To age 65 is the most common option, but other options such as 2 or 5 year benefit durations can also be requested.

Cost of Living Adjustment:

For disabilities that last for several years, inflation can diminish the ongoing value of the LTD payments. Cost of Living Adjustment (COLA) is an optional add on to the LTD benefit that can be used to reduce the impact of inflation. COLA indexes the disability payment against the Consumer Price Index (CPI). There is typically a limit as to how much COLA will increase the annual disability payment.

All Source Maximum:

The purpose of the all source maximum is to ensure that an employee on disability does not receive comparative or more income than their pre-disability earnings, thus removing the financial incentive to return to work. The all source maximum is typically around 85% of an employees pre-disability income. If the LTD benefit is taxable all source is 85% of pre-disability gross earnings. For non-taxable LTD benefits, the all source maximum is usually based on 85% of after-tax earnings.

Other sources of income are often referred to as offsets. Some examples of direct offsets are if the disabled employee was injured at work and is eligible for workers comp, or is receiving income from an auto insurance plan, income from government sources such as CPP/QPP etc.

Continuation of benefits:

Unlike other benefits, Disability benefits continue to be paid to a disabled employee even in the event the group contract is terminated or moved to a different carrier. This ensures a disabled employee doesn’t lose their disability income. Note that the disabled employees other benefits may move to the new carrier, for example their EHB and Dental coverage.

Waiver of premium:

LTD plans often include a waiver of premium benefit. This means that if a disabled employee is approved for LTD benefits, the LTD premiums for that employee are waived while the employee is receiving LTD benefits.

]]>